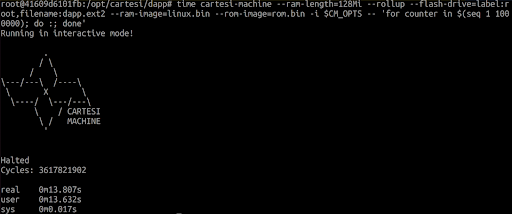

Introducing PRT Honeypot: Cartesi’s First Rollup App with PRT Fraud-Proof System on Ethereum Mainnet

Cartesi’s PRT Honeypot is the first Rollup application equipped with the PRT fraud-proof system, putting the appchain stack to the test. It marks a key milestone toward decentralization and trustless security, aligned with L2BEAT’s standards.

Written By Marketing Unit